Less Stress, More Success

Tailored tax & accounting solutions to help your business grow with confidence.

We’ve worked with hundreds of business owners since 2009, and no matter the industry or size, most business owners struggle with the same painful issues. Any of this sound familiar to you?

Tax Panic

How much do I owe? Do I have the cash?

Receipt Scramble

Where are those receipts and tax filing documents anyway?

Lost in Translation

Where did my cash go when the accountant says I’m profitable?

Bookkeeping Fatigue

That heavy feeling when you’ve put bookkeeping off too long again

Payroll Pressure Paranoia

Lying awake wondering if you have enough in the bank.

Tax FOMO

What tax breaks am I missing and don’t know to ask about?

The Truth About Your Competitors

If taxes and bookkeeping feel like the heaviest item on your to-do list, it’s time to level up.

82%

of small businesses fail because of poor cash flow management (Business.com)

60%

of small business owners say that bookkeeping and taxes are the worst part of owning a business (National Small Business Association)

82h

Small business owners spend approximately 82 hours annually on tax compliance (IRS)

How to Have a Thriving Business

95%

success rate for small businesses that look at financial statements weekly (Netsuite)

82%

of small business owners who experienced growth in the past year cited effective financial management as a key factor (Sage)

You Handle Your Business, We Handle Your Books & Taxes

Fixed Pricing, No Surprises

In your free strategy session, we uncover exactly what you need to sustain and grow a healthy business and design a clear but customized plan for you with no hidden costs or misc. fees.

Scale Up or Down

As your business grows and your needs change, we proactively recommend adding services to continue fueling growth or stopping services you’re ready to take in-house.

Optional Add-Ons

Customize your service package today with add-on services including individual tax preparation and planning, M&A support, budgeting, and more.

Year Round Support

Timely communications and regular phone calls, emails, and video meetings as needed within the scope of your current services.

Tax Preparation, Filing & Representation

Our Packages include planning, advising, preparation and filing for your business and family. And should you need taxing authority representation in case of an audit, we’ve got you.

Confidence in Your Finances

Clarity on taxes. Security with cash flow. Confidence to grow. We’re your accounting & tax partner in a thriving, successful business.

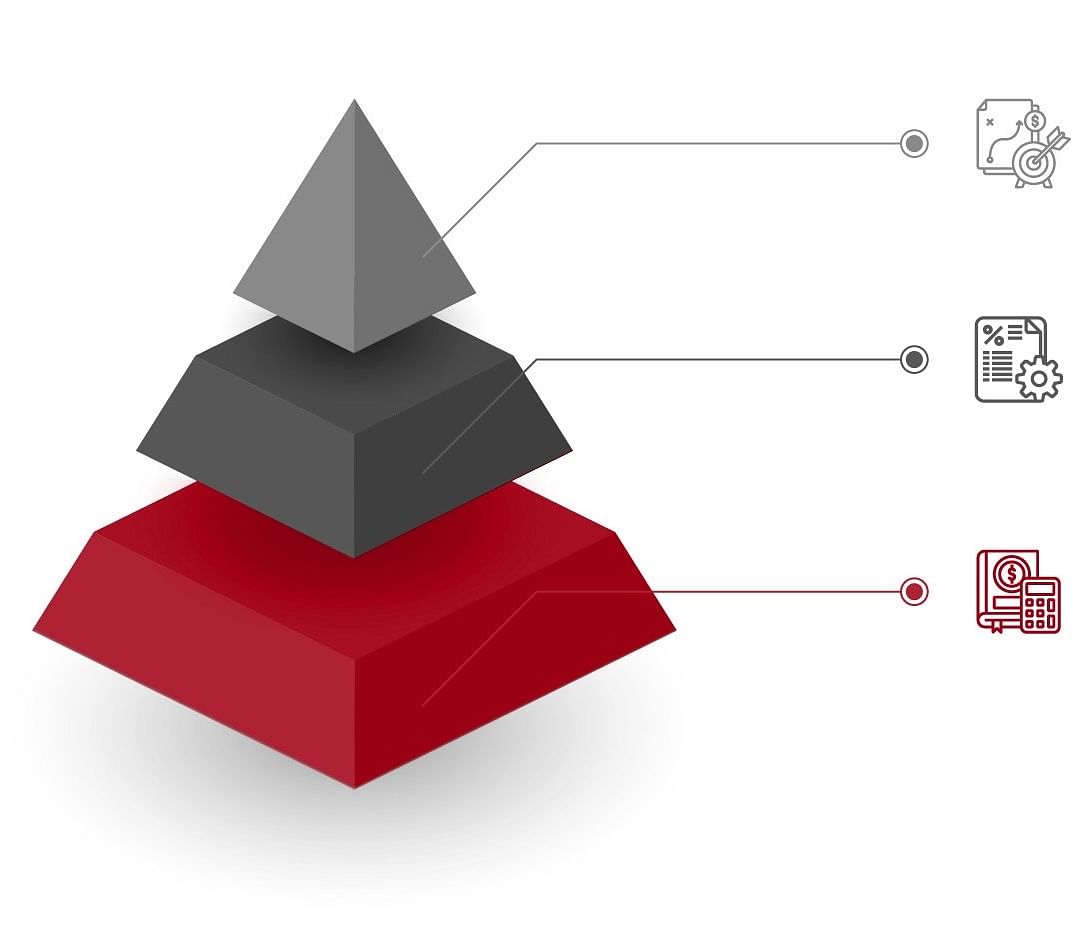

Red Bike Advisors Financial Fitness Framework

Clean books are the foundation of a strong financial position. We build on that with money-saving tax strategy and strategic advisory to help you build a sustainable, growing business.

Strategic Financial Planning

Breakaway from the Pack: Create exponential company value with strategic financial planning

Tax Strategy

Build on clean books with money-saving tax strategy

Accounting & Bookkeeping

The foundation for good financial fitness (most of your competitors don’t bother)