Stop the Stress and Get Tax Relief

Let the tax resolution experts at Red Bike Advisors help you resolve IRS and state tax problems.

Tax Resolution Services

Facing IRS pressure? Red Bike Advisors helps you regain control with expert tax relief services.

Dealing with tax problems can be stressful. Whether you’re facing back taxes, IRS notices, or wage garnishments, it can feel overwhelming. That’s where tax resolution services come in. At Red Bike Advisors, we help individuals and business owners find solutions to their tax issues quickly and clearly. Our goal is to reduce your stress and help you get back on track financially.

At Red Bike Advisors, we help individuals and business owners resolve tax problems efficiently without confusion or delay.

What Are Tax Resolution Services?

Tax resolution services are designed to help people who owe money to the IRS or state tax agencies. These services include negotiating payment plans, reducing tax debts, stopping collection actions, and fixing tax return mistakes. Whether you missed a filing deadline or got hit with unexpected penalties, tax resolution can help you find a path forward.

Whether you’re an individual, small business, or self-employed professional, our team provides strategic guidance to protect your finances and reputation.

The Truth About IRS Tax Issues

$73.6B

IRS assessed civil penalties in 2022

72K

IRS Appeals cases closed in 2022

$13B

paid by taxpayers in installment agreements in 2022

Why You Might Need Tax Resolution

Many people need tax resolution because of common issues like:

Unpaid or underpaid taxes

Frozen bank accounts

Audit threats or IRS letters

Wage garnishments

Tax liens on property

Missed tax filings

These situations don’t go away on their own. Red Bike Advisors helps you take control of the situation—with clear steps and strong representation.

Common Tax Problems We Handle

At Red Bike Advisors, we work with a wide range of tax problems with income, payroll, and sales tax.

Some of the most common include:

Unpaid Taxes

If you owe the IRS or a state agency, we help you create a plan to pay it off.

Back Tax Filings

If you’ve missed filing returns, we help you catch up and stay compliant.

Tax Liens

We work to remove or resolve liens placed on your property due to tax debt.

Wage Garnishment

We can help stop or reduce wage garnishments by working directly with NCDOR and the IRS.

Bank Levies

If your account has been frozen, we act fast to negotiate with tax authorities and protect your funds.

Audit Representation

If you are being audited, we speak to the state or the IRS on your behalf and help you through the process.

Types of Tax Relief Options Available

Depending on your situation, there may be different tax relief options available. At Red Bike Advisors, we help you find the best fit, including:

Installment Agreements

These allow you to pay your tax debt in monthly payments you can afford.

Offer in Compromise (OIC)

This may let you settle your debt for less than you owe if you qualify.

Currently Not Collectible Status

If you are going through a hardship, we may be able to pause IRS collections.

Penalty Abatement

We may be able to remove or reduce penalties that have been added to your tax bill.

Innocent Spouse Relief

If you are being held responsible for your spouse’s tax debt, we may be able to help.

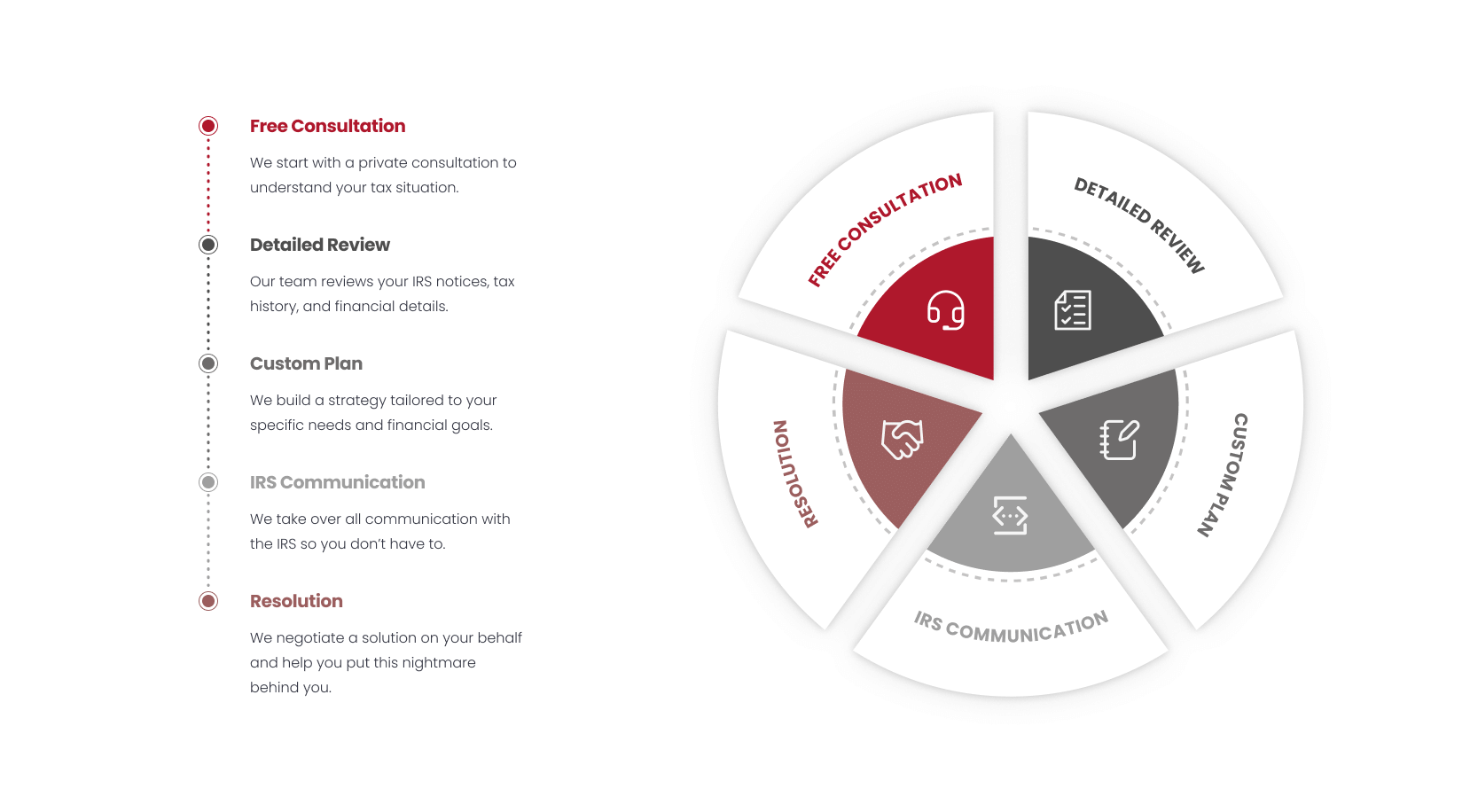

How Our Process Works

Our tax resolution services follow a clear, step-by-step plan. Here’s what you can expect:

Why Choose Red Bike Advisors

Choosing the right company for tax resolution is critical. At Red Bike Advisors, we put your peace of mind first and we provide:

-

Personalized, judgment-free service

-

Transparent pricing with no surprises

-

Experienced IRS negotiators and licensed professionals

-

Respectful, plain-language communication every step of the way

Take Control of Your Taxes Today

You don’t have to face state tax collection agencies or the IRS alone. If you are struggling with tax debt or facing collections, the best time to act is now.

Contact Red Bike Advisors today to schedule your free consultation. Let us help you resolve your tax problems, protect your finances, and find peace of mind.

Or get in touch with us by phone or email

Frequently Asked Questions

Tax Controversy & Resolution

Call or email us immediately so we can help. We’ll do a free consultation to assess your situation and get you on the path to resolution. The sooner the better–if you wait, some resolution options may not be available.

Possibly. Our specialized team understands the inner workings of the IRS and various state departments of revenue and taxation, and exactly what relief methods are available to you. We speak the language of the IRS, know what programs apply to your situation, and act as your advocate to the tax authority.

Each case is different, but once we’ve evaluated your situation in our free consultation, we’ll provide you with transparent fixed fee pricing that won’t change as we move toward resolution. What we often hear from our clients is that the relief after working through tax issues is priceless!

Each case is different, but generally speaking most tax controversy cases are resolved within 6-18. Once we assess your situation in your free consultation, we’ll be able to give you an approximate timeline. Rest assured, we’ll work swiftly to resolve your case with the taxing authorities.

Remember when you were a kid and you got caught doing something, and your parents said some version of “it’s only worse for you now because we caught you and you didn’t tell us up front”? Same thing when it comes to avoiding taxes: It’s much better to clear up and clean up before you get a notice, not after. We can help you get on the path to getting current on your taxes and leaving behind the stress of wondering when–not if–you’ll get caught.