10 Things to Note About the Big Beautiful Bill

By Gretchen Roberts

So complicated.

Imagine this mess of wires is a mini-version of the tax code. Nearly impossible to unravel, so let's keep plugging more wires in on top of it, extending and repairing existing wires, and generally making more of a tangle than before.

In other words, the provisions in the BBB aren't going to make tax compliance easier, but remember that the tax code is a game, and the winners are those who are able to apply it in order to maximize deductions, reduce taxable income, and make tax-forward buying decisions.

So, let's attempt to untangle this thing, at least in our minds. Please keep in mind that this commentary is strictly focused on the facts of the bill and how they'll affect taxes, and is in no way a political statement.

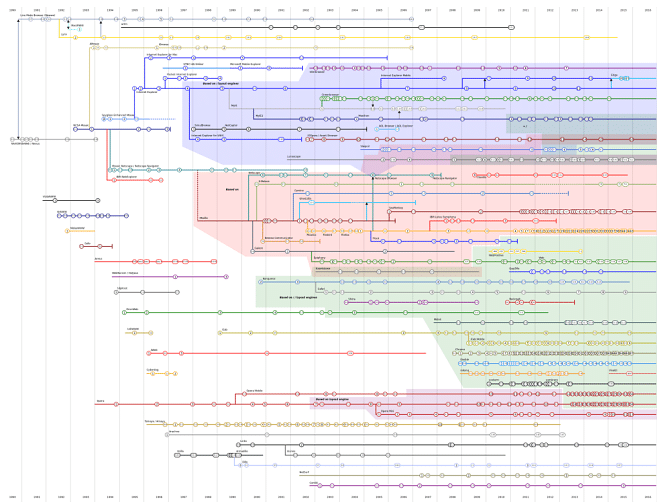

A Buildout / Extension of the Tax Cuts and Jobs Act of 2017

Much of the BBB is an extension, buildout, or tweak of the 2017 Act, which led to sweeping tax law changes all set to expire this year. 'Course 2025 seemed really distant back in 2017, before Covid and a host of other things wore everyone down, but here we are already.

The Bottom Line: What Am I Gonna Save?

According to the Tax Policy Center, the average American will save about $2,900 in 2026 due to the BBB, with higher income earners saving a larger percentage than lower income earners.

(And, in case you're wondering, that personal savings will increase the national deficit by somewhere between $1.7 and $2.9 trillion over the next decade.) Source

Key Changes

Let's zoom in on some of the key changes for individuals and small business owners.

1. Personal Tax Rates: Rate cuts made in 2017 were made permanent with the BBB. (In other words, hey Congress, thanks for giving us something we already have!)

2. Standard Deductions: These went a lot higher in 2017 and were made permanent with the BBB. But unlike the personal tax rate staying status quo, standard deductions will temporarily go higher from 2025-2028 at $15,750 for single filers, $23,625 for head of household, and $31,500 for joint filers. If you regularly come in under that, you'll have lots less paperwork to scrounge up at tax time.

3. Child Tax Credits: It costs several hundred thousand dollars to raise a kid to 18, and in 2017 Congress doubled the annual credit from $1,000 to $2,000 and raised the income threshold phasing out the benefit. The BBB made the $2K permanent, adds a temporary boost to $2,500 from 2025-2028, and then starts indexing for inflation (like we parents have to!).

4. Qualified Business Income: After those lucky C-corps got their top tax reduced from 35% to 21%, Congress threw pass-through business owners a bone and created a new category of income called Qualified Business Income that allows you to deduct 20% on your taxable business income (subject to many caveats, exceptions, provisions, and phaseouts, of course). The BBB keeps this general framework and makes QBI rules permanent, which helps mitigate some of that pass-through income tax for business owners.

5. Accelerated Depreciation: If you bought qualifying property placed in service after January 19, 2025, you get a bonus! 100% bonus depreciation was restored (would have been 40% this year if provision was allowed to expire). The BBB also expands the Section 179 first-year expensing cap to $2.5 million, with phaseouts beginning at $4 million, and lets businesses expense 100% of manufacturing facilities for projects started between Jan. 19, 2025 and Jan. 1, 2029. Finally, if you've done any R&D lately, you can choose between deducting 100% of development costs in the year incurred or amortize them over the life of the research. This provision is retroactive to Jan. 1, 2022, which means you could file an amended return and request a refund of those taxes paid.

6. SALT Deduction: For those of you who have had to mess around with PTE (pass through entity) taxes, this one's for you. The 2017 Act capped state and local income tax deductions on your personal return at $10,000, so most states passed laws allowing you to pay state income tax from your business account and then take it as an expense, which would end up as a federal deduction on your personal taxes. If your state and local taxes exceed $10K, this saves a lot of money (but generally is confusing for most business owners). The BBB raised the cap to $40,000 from 2025-2029 with phaseouts for incomes above $500,000. This means if your business is going to pay less than $40K in state taxes, you won't need to bother with the PTE. (If you're a client, we're keeping an eye on this for you.)

7. Estate Tax: This doesn't apply to many people (The IRS receives fewer than 10,000 estate returns per year), but if this is you, your beneficiaries will thank you. The BBB raised the unified credit to $15M per person (the amount of assets you can transfer without incurring federal estate tax).

8. Green Energy: If you were debating on whether to go for the Tesla Cybertruck or not, make a decision soon: Tax credits for electric vehicles expire after Sept. 30, 2025. And residential solar systems have the same fate: tax credits will be eliminated after 2025. Finally, the BBB phases out incentives for large-scale wind and solar projects.

9. Random New Stuff: So far we've talked about extensions and non-extensions to the 2017 Act. Here are some new additions for 2025, all subject to assorted income thresholds:

i. Tip Tax: No income tax on server tips under $25,000 from 2025-2028. Payroll tax still applies

ii. Overtime: No income tax on overtime under $160,000 from 2025-2028. Payroll tax still applies.

iii. Social Security: A temporary $6,000 increase in the standard deduction for seniors age 65 and older, expiring after 2028.

iv. Car Loans: Given the average cost of a new car has climbed north of $48,000, this is welcome news: Up to $10,000 of interest per year on new vehicles assembled in the United States applies through 2028, phasing out above certain income thresholds.

10. Wild Cards: Keep in mind that in the end, this is politics, and a bill of this magnitude couldn't possibly pass without a few surprise provisions, including....

i. Startup Stock: Expands breaks for Qualified Small Business Stock (popular with angel investors).

ii. Whale Hunting in Alaska: This provision increases the maximum allowable deduction for whale-hunting related expenses from $10,000 to $50,000 (but only to whaling captains recognized by the Alaska Eskimo Whaling Commission who participate in sanctioned whale hunts).

iii. "Trump Accounts": The government will kick-start a savings account with $1,000 for children born between Jan. 1, 2025 and Dec. 31, 2028. Families can contribute another $5,000 each year until the child turns 18. Of course, there are restrictions on the account's use at age 18, 25, and 30 (because nothing is ever truly free).

iv. 529 Expansions: Beginning in 2026, the exclusion for withdrawals used for K-12 tuition doubles from $10,000 to $20,000, and there are seven new categories of tax-free expenses, including curriculum, books, online resources, tutoring, educational therapies for students with disabilities, dual enrollment fees for college courses, standardized test fees (such as SAT), and homeschooling expenses.

v. Adoption Credit: Cash refund for any amount of your qualifying credit that exceeds actual tax, up to $5,000

vi. Gambling Losses: Effective in 2026, the itemized deduction goes from 100% to 90%, which means if made $100K gambling and subsequently lost the same amount, they no longer wash and you'd be taxed on $10K.

When's this all happening again?

Actual footage of tax changes (kidding)

To summarize the timeline of the BBB, it's complicated. Some provisions are retroactive, some started at the beginning of this calendar year, some start at another time, some expire, some are permanent (as permanent as anything can be in Washington, that is), and, in short, it's all over the place. But don’t worry — we’ve got your back at Red Bike Advisors. Book a free strategy session today, and let us help you simplify, streamline, and save on your business finances and both business and personal taxes.