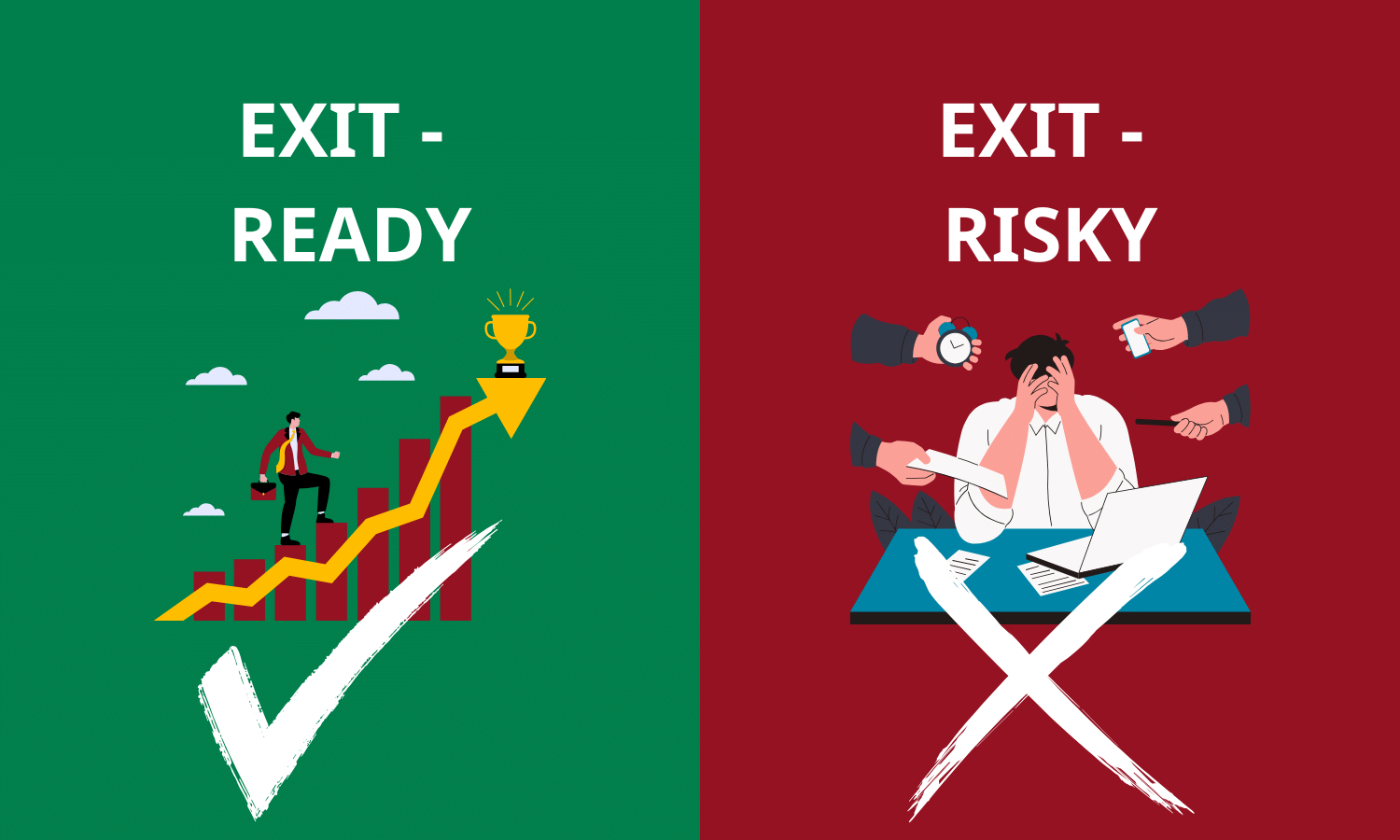

Exit-Ready or Exit-Risky? How to Maximize Your Business Value

By Gretchen Roberts

Answer this question: If you took a 3-week vacation and didn’t check in at all, would the business hum along or grind to a halt without you?

What Makes a Business Exit-Ready?

When buyers, investors, or even lenders look at a company, they’re all asking the same question: “Is this business transferable?”

A transferable business has:

- Clean, reliable financials. Financial, legal, and operational due diligence are the backbone of a business sale and acquisition. Messy books are a red flag that tanks credibility. If your financials are full of issues, what else might they find in operations, sales, and other key areas of the business?

- Systems, not heroes. Processes can't rely on one superstar (often the owner) or be bottlenecked by someone at the top (again, often the owner). The goal here is to delegate down and empower your team to execute, document processes, and refine as needed.

- Diversified customers. No single client should make up a dangerous percentage of revenue. “Dangerous” is subjective depending on the type of business, size, etc., but a good rule of thumb is no more than 20%. Think of it this way: If your largest client left, would the business tank or at least struggle significantly?

- Scalable structure. The ability to grow without breaking. This means that top-line growth is paired with sustainable cash flow and healthy profit. Yes, these can get out of balance during high-growth periods, but over time should tell a scalable story.

But I don’t even want to sell now...or ever.

Even if you never put your business on the market, the same factors that increase value for a buyer also reduce risk and stress for you.

Clean books mean you can “Know Your Numbers and make better business decisions based on accurate financials. Plus, when tax time rolls around, you’re ready to go, without big surprises.

Strong systems mean you’re not the bottleneck...and maybe you could take that 3-week vacation to a remote island and the business wouldn’t tank.

Diversified revenue means that you don’t go into “payroll panic” when a large customer or client leaves. That peace of mind is priceless.

And finally, when you’re structured to grow sustainably, you and your business can handle the twists and turns on the journey to more time, profit, and freedom for you. All of a sudden, you own your business and your business stops owning you.

How to Move Toward Exit-Ready

Building a transferable business happens step by step:

- Clean up your books: Reliable financials are the foundation.

- Document your processes: If it lives in your head, it’s a liability.

- Spread your risk: Don’t let one customer or vendor hold the keys to your business.

- Build leadership depth: Empower a team that can operate without you.

- Track your value drivers: Tools like our Sale-Ready Scorecard show where you stand today and where to focus next.

The Red Bike Advisors Approach

At Red Bike Advisors, we help owners shift from reactive firefighting to proactive planning. That often starts with financial clarity — but it doesn’t stop there. We guide clients through the structures, systems, and strategies that make a business both easier to run and more valuable over time.

The Bottom Line

Exit-ready businesses aren’t just easier to sell. They’re easier to own. When your company can run without depending on you, it’s more profitable, less stressful, and more valuable today, not just someday.

Are you ready to get Exit Ready? Schedule a free strategy session and let’s discuss how we can help you unlock more profit, time, and growth...whether you want to sell or not.