Introducing the Family Office: A New Era of Integrated Tax, Finance & Wealth Strategy

By Gretchen Roberts

Now, we’ve made the decision to elevate our tax practice into a full-service, holistic Family Office.

This evolution brings together everything we’ve always done well—tax compliance, strategic planning, and year-round advisory—and enhances it with a coordinated, multidisciplinary approach once reserved only for the ultra-wealthy. Our goal is simple: to help you intentionally build the kind of long-term financial freedom we call being“financially retired.”

We already serve as your year-round partner for accounting, tax compliance, finance strategy, and tax strategy. With the Family Office, we’re expanding that partnership even further.

How to Build Breakaway Personal Wealth

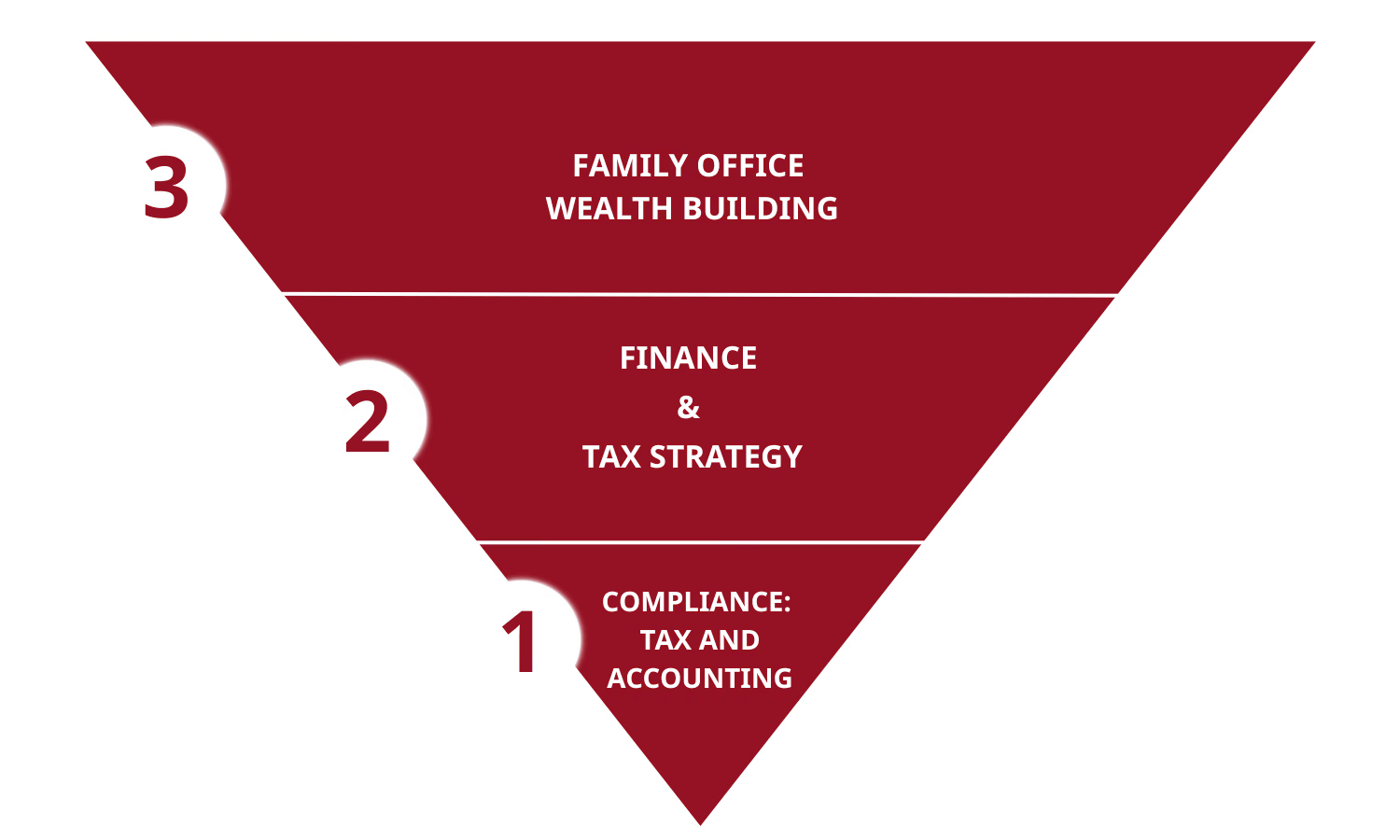

To understand the importance of a Family Office, it’s helpful to look at what we call the Pyramid of Breakaway Personal Wealth, which outlines how wealth is built and preserved over time.

1. Compliance: Tax and Accounting. All those things you have to do to protect your business and keep you in good standing with the IRS, but aren’t necessarily interesting or where wealth is created. Think of this as the day-in, day out back office piece of running a business and filing taxes.

2. Finance & Tax Strategy. Here’s where real growth begins. This level focuses on unlocking more profit, reducing your tax liability, increasing efficiency, reclaiming time, and strategically positioning your business and personal finances for long-term success. Here, we're making incremental improvements and leveraging strategic tax savings over a decade or more.

3. Tax-First Wealth Building. This level is all about helping business owners become financially retired. Achieving this requires an integrated strategy across tax, investments, legal structures, insurance, risk mitigation, estate planning, exit strategy, and more... in other words, the Family Office, helping you build a lifetime of wealth and become financially retired.

What Does It Mean to Be “Financially Retired”?

Being financially retired means one thing: freedom.

You can work for an active income, but it becomes optional, not required. It’s about having enough assets to live off of passive income.

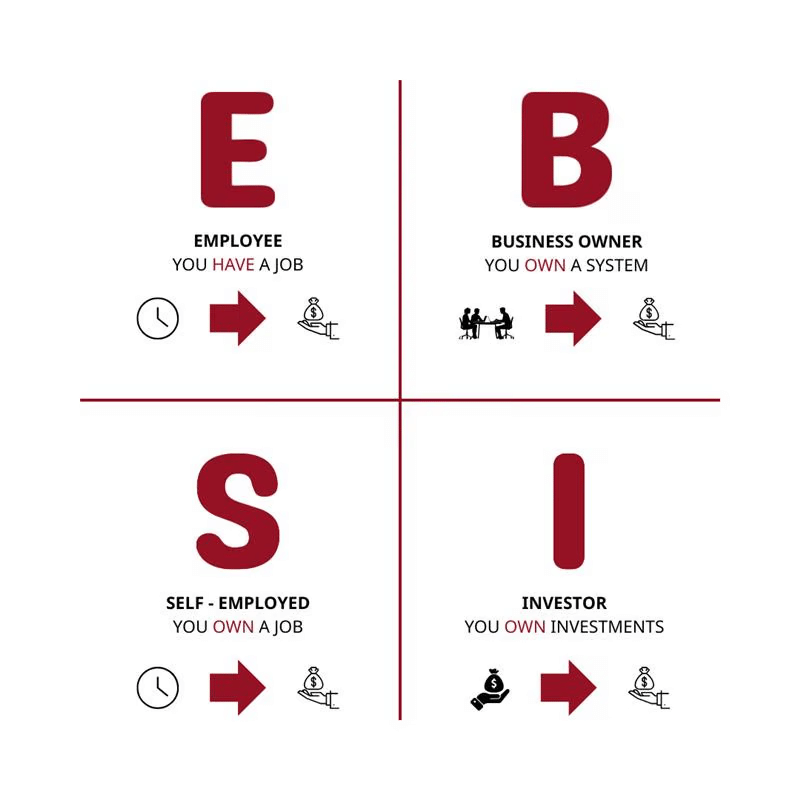

If you’re familiar with Robert Kiyosaki’s Cash Flow Quadrant, it’s moving from the left side to the right one, the key to unlocking financial retirement.

As Manoj Arora says, “Financial Freedom is less about financials and more about freedom.”

What is a Family Office?

A Family Office is a coordinated system that brings all areas of your financial life, like tax, investments, legal, insurance, business planning, and estate strategy, into one unified approach. Instead of receiving fragmented advice from separate professionals, a FamilyOffice aligns every decision, so your strategies support each other and your long-term after-tax results.

Traditional financial services don’t work this way — advisors typically operate independently, which can lead to conflicting recommendations, missed tax savings opportunities, and unnecessary costs. The Family Office model eliminates these gaps by taking a proactive, tax-first, multidisciplinary approach that evaluates your entire financial picture at once.

This coordinated framework is what Financial Gravity refers to as Efficiency Alpha. The added value is created through smarter tax treatment, better coordination, and lower costs, without taking on more risk. Once reserved for the ultra-wealthy, this level of integrated,conflict-free guidance is now available to business owners and families like yours.

Ultimately, a Family Office gives you one trusted point of contact backed by a team of specialists working together on your behalf—so you can protect, grow, and transfer your wealth with clarity and confidence.

What is the Family Office Advantage?

The Family Office Advantage is the difference between traditional financial services and a fully integrated, conflict-free model.

Over the years, we’ve seen the same systemic problems in the financial world:

- Disconnected tax and financial strategies

- Tools and investments placed in the wrong structures

- Buying and selling based on emotion instead of strategy

- Surprise tax bills from mutual funds

- Hidden fees and unnecessary turnover

- Complicated, ever-changing tax code

- Commission-driven “advice”

The Family Office Advantage™ fixes these issues by:

- Coordinating advice across all disciplines

- Prioritizing tax-first decision-making

- Ensuring every strategy is holistic and conflict-free

- Helping you avoid costly mistakes

- Aligning legal, estate, investment, and tax strategies under one roof

This approach is the future of financial advice—and exactly what today’s business owners and families need.

Why We Partnered with Financial Gravity

With our partnership with Financial Gravity, our mission has expanded beyond helping you simplify, streamline, and save in the near term. Financial Gravity is a public firm whose commitment to democratizing the multi-family office aligns perfectly with our own.

Together, we’re bringing a fully integrated approach, combining business growth, tax planning, investments, and estate planning to help you maximize your long-term after-tax results and move confidently toward becoming financially retired.

Financial Gravity brings deep expertise in:

- Tax mitigation

- Risk management

- Estate and legacy planning

- Insurance and asset protection

- Investment management

- Business structuring and succession planning

Their specialists and analysts support everything from tax architecture to advanced wealth strategies. Through this partnership, we can deliver the kind of cohesive, conflict-free advice that was historically available only to the ultra-wealthy.

As your Family Office Director, I will remain at the center of your financial world, supported by a robust interdisciplinary team dedicated to your long-term success.

What does the process look like?

The Family Office experience begins with a complimentary in-depth diagnostic called the Taxes First, Then Math Analysis (TMA Report) - a proprietary Financial Gravity analysis.

Think of it as an X-ray of your entire financial life.

It examines four critical areas:

1. Taxes: Is an inefficient tax strategy in your portfolio killing your compounding?

2. Cost: What hidden or unnecessary fees exist?

3. Diversity: Is your portfolio appropriately diversified?

4. Risk Alignment: Do your investments match your true risk of tolerance?

The TMA Report evaluates:

- Your tax return

- Your investment statements

- Your risk exposure

- Your overall financial structure

It reveals what’s working, what’s broken, and what needs improvement.

Unlock the Family Office Advantage

If you’re ready to explore the Family Office Advantage, schedule an intro call with me and Michael French, EVP of Financial Gravity. We'll share more about the strategy of driving wealth through after-tax compounding and get you started with your complimentary After Tax Compounding Analysis.