The Truth About Write-Offs: What’s Really Deductible

By Gretchen Roberts

But here’s the problem: social media advice (what we jokingly call “TikTok Tax), friendly “tips,” and guesswork lead to costly mistakes. Either you leave money on the table, or you risk IRS trouble.

Here's the truth: The IRS doesn’t care about what your cousin or tax influencer told you. They care about three tests:

- Is it a real business?

You need an actual business with the primary goal of making a profit—not just a hobby that occasionally makes money.

- Have you officially started?

You need an actual business with the primary goal of making a profit—not just a hobby that occasionally makes money.

- Is the expense “ordinary and necessary”?

Ordinary = common in your industry.

Necessary = helpful to running your business.

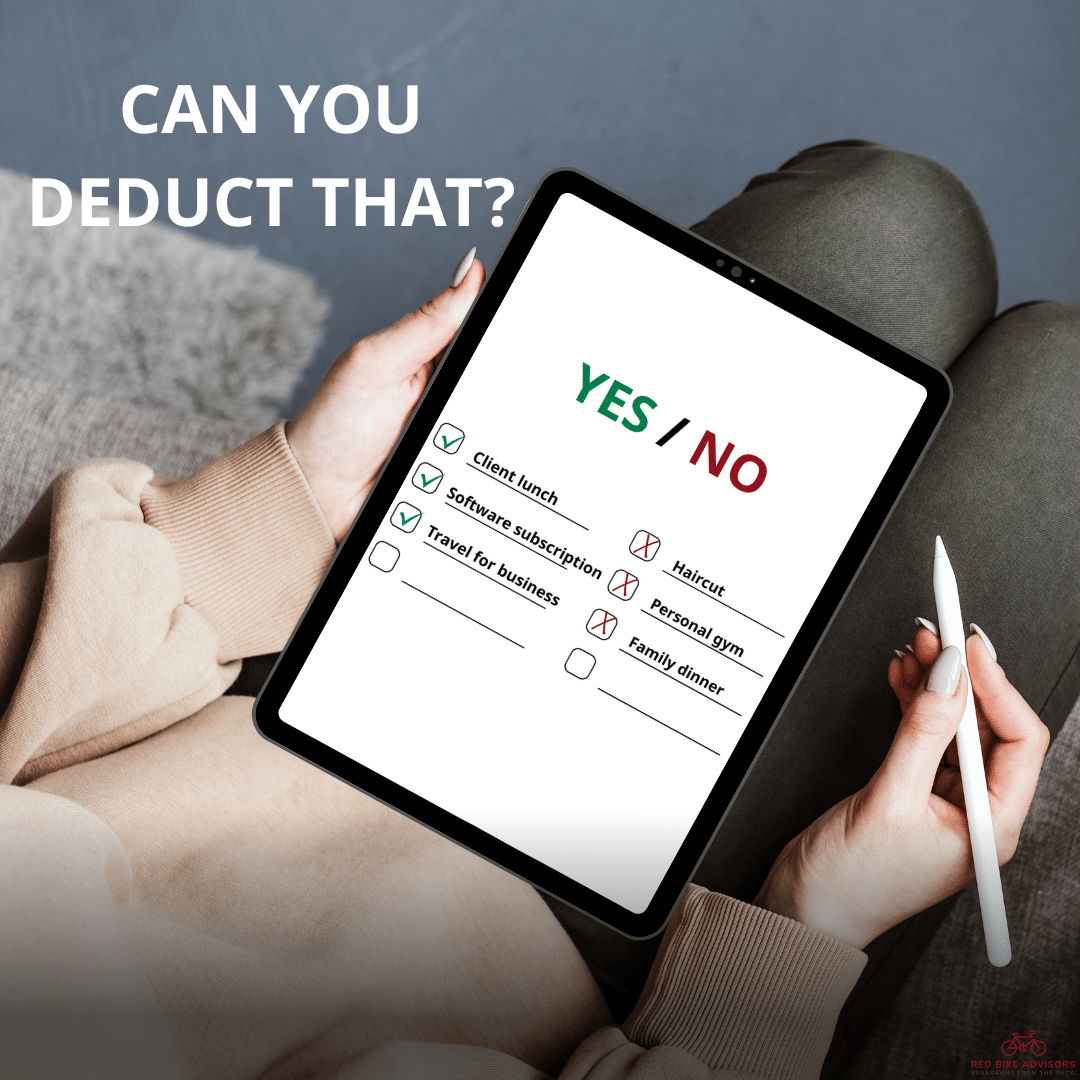

Yes, that means client lunches may qualify with proper documentation. No, it doesn’t mean you can write off haircuts or gym memberships because they “help your brand.”

The Cost of Confusion

If you don’t know the rules, you may overpay tax every year. Or worse, you may underpay and invite an audit.

Neither one helps you grow a profitable, sustainable business

Cheat Sheet for Proper Tax Documentation

- Keep receipts and notes. Write down the “who/what/why” for meals, travel, and client-related expenses

- Stay organized. Clean books mean you never scramble at tax time.

- Ask before you assume. A quick check-in with a proactive advisor saves thousands (and stress).

- Some deductions and credits require extra paperwork. For example, taking the FMLA credit requires very specific items to be on your policy ahead of the FMLA taken.

- Some deductions and credits aren’t worth it. We advocate for you taking every legal deduction available to you, but some require a lot of documentation or setup work or financial investment, and it may not be worth it to you. I like to look at this as, will this deduction save you enough to make up for the time you have to spend documenting for it? That answer varies by business owner but is important to consider. Your time may be better spent driving revenue than documenting your child’s work hours, for example

The Bottom Line

Every dollar in legal deductions is profit that stays in your pocket. Don’t guess your way through it—know the rules and set yourself up to win.

Want to make sure you’re taking advantage of every deduction legally available to you?