What to expect on an ongoing basis in your relationship with Red Bike Advisors

By Gretchen Roberts

Each month, we request and reconcile your financial data — categorizing transactions, reviewing accounts, and delivering your “Know Your Numbers” reports. This process ensures your books stay accurate, current, and audit ready.

Once your books are closed, we lock that period in QuickBooks to protect the integrity of your financials. This prevents costly errors and keeps your reports consistent with filed tax returns.

To keep things moving:

Upload all requested documents to your secure Accounting Portal. (Email is not encrypted and can easily go to the wrong person!)

Submit information as soon as possible and no later than the 15th of the month for a timely close.

Avoid mixing business and personal transactions (your accountant will thank you).

Tax Filings and Estimates

Throughout the year, we’re here for big and small questions — whether you’re planning growth, thinking of starting a retirement plan for your team, or making a major purchase.

When tax season rolls around, we handle everything from organizers and projections to tax returns and filings. Clean books mean faster turnarounds and better results. If anything changes in your business or personal life, let us know so we can adjust your strategy proactively.

Breakaway Business Growth Accelerator

If you’ve signed up for the Breakaway Business Growth Accelerator, get ready to unlock more profit, time, and growth in your business.

These quarterly or monthly sprints are designed to power your business through its lifespan.

We start with Quick Wins & Solid Foundations: Immediate visibility, quick cash impact, and confidence-building in your financials.

Phase 2 is Profit, Cash, and KPIs, a focus on bankable profit (not phantom profit!) and benchmarking, then beating, your highest-impact industry benchmarks.

Phase 3 is about Scaling with Confidence, ensuring growth doesn’t kill cash or margins.

In phases 4 and 5, we focus on The Ultimate Cash-Out: Building a business that sells for top dollar—or that you love so much, you want to keep it yourself.

And because, as Ray Kroc said, “If you’re green, you’re growing; if you’re ripe, you rot,” we continue these sessions with you as long as you need them, and as long as there’s more opportunity to grow, scale, and profit.

Your Very Own Family Office

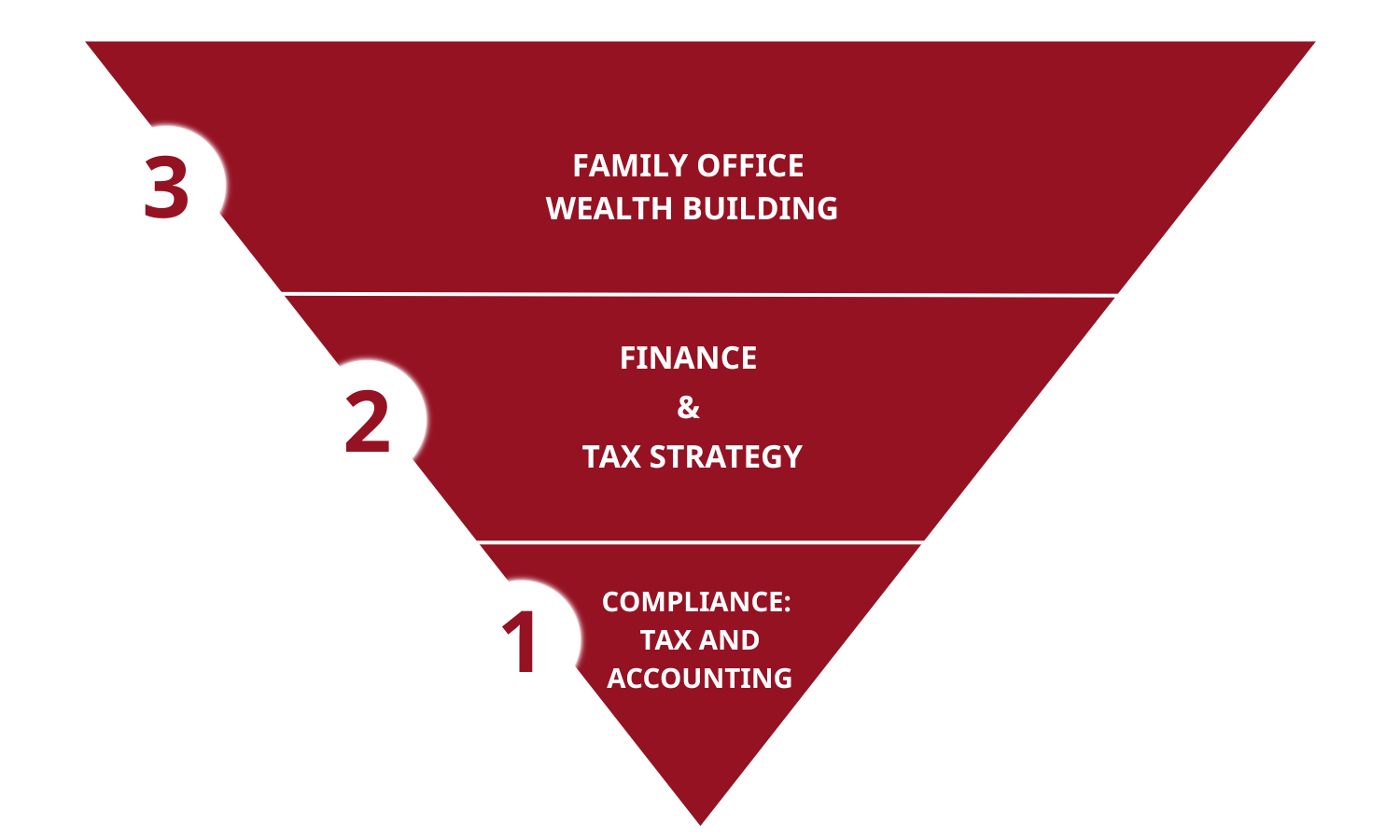

Whether you’re just starting your wealth-building journey or are at the point where you want to know how to get through retirement tax-efficiently, our democratized Family Office integrates tax, investment, and estate planning to help our clients financially retire.

The truth is, most of your experts—financial planners, attorneys, estate attorneys, tax advisors—operate in silos, interacting occasionally with each other at your request but never fully seeing your long-term picture holistically.

The Family Office Advantage ensures all of your financial assets are working together, just like the wealthiest Americans have their own super team of advisors all dedicated to maximizing tax efficiency in their portfolios.

With integrated business growth, tax strategy, wealth management, retirement planning, and estate planning, we’re taking a “taxes first” approach to wealth building both nearterm and long-term.

Our Year-Round Promise

We believe financial clarity isn’t seasonal. You can expect:

- Regular outreach and reminders for tax payments and filings.

- Transparent communication and predictable timelines.

- Strategic insight that evolves with your business.

When you partner with Red Bike Advisors, you’re not just getting accounting and tax support. You’re building a long-term rhythm of financial confidence and control.

Ready to take your next step toward financial fitness? Book a free strategy session and see how Red Bike Advisors can help you break away from the pack.