Forensic Accounting Services

By Richard Pasquantonio, CPA/CFF, CFE, CDFA, CTRS

Director of Forensic Accounting Services

Forensic Accounting Services

What Is Forensic Accounting?

Forensic accounting is a specialized field of accounting that focuses on investigating financial records to detect fraud, misconduct, or accounting irregularities. Unlike standard bookkeeping or auditing, forensic accountants dig deeper—analyzing transactions, tracing assets, and uncovering hidden financial activity.

Common applications for forensic accounting include:

-

Legal disputes and commercial litigation

-

Shareholder or partnership conflicts

-

Divorce and family law matters involving business assets

-

Internal investigations for misconduct

-

Insurance claims and business interruption reviews

Forensic accountants frequently work with attorneys, law enforcement, or business owners to present clear, evidence-based findings in court or during settlement discussions.

Forensic Accounting: A Highly Specialized Field

5,323

total fraud & forensic accounting companies in the U.S. (IBISWorld)

92,459

total accounting companies in the U.S. (IBSWorld)

< 6%

Less than 6% of accounting firms have fraud and forensic expertise (IBSWorld)

When to Hire a Forensic Accountant

You should consider forensic accounting services if you face:

Unexplained drops in profits or cash flow

Regulatory investigations or legal complaints

Internal audits that reveal unusual transactions

Complex divorce cases involving hidden income or assets

Business disputes between partners or shareholders

Red Bike Advisors uses proven investigative techniques, industry-leading tools, and professional judgment to deliver clear answers and protect your financial interests.

Fraud Investigation Services

What Is a Fraud Investigation?

A fraud investigation is a detailed examination of financial records, transactions, and business processes to uncover and document fraudulent conduct.

Common types of accounting fraud we investigate include:

Embezzlement

Diverting company funds for personal use

Payroll Fraud

Ghost employees, altered pay rates, or timecard manipulation

Tax Evasion

Underreporting income or inflating deductions

Fictitious or Inflated Billing

False invoices or overstated amounts owed

Insider Theft & Asset Misappropriation

Unauthorized use of company resources

Fraud often starts small and escalates. Early detection can save a business thousands—or even millions—of dollars.

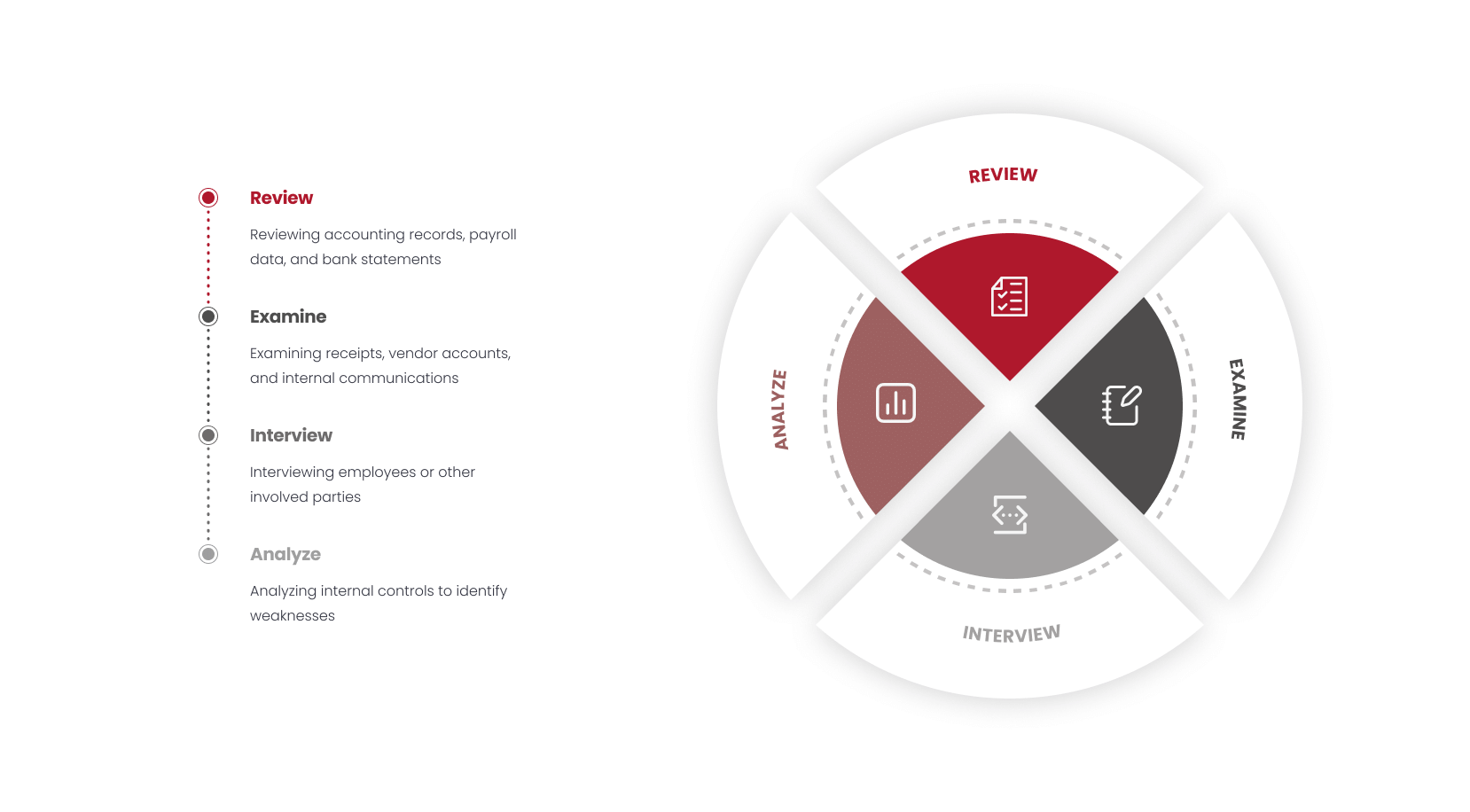

Our Fraud Investigation Process

At Red Bike Advisors, fraud investigations may include:

Our findings are compiled into a clear, legally sound report that can be used for internal decision-making, insurance claims, law enforcement, or litigation. If needed, we also provide expert testimony to support your case.

How These Services Protect Your Business

Both forensic accounting and fraud investigations are about getting to the truth and reducing risk. Beyond uncovering financial wrongdoing, we help you strengthen internal controls, improve oversight, and prevent future losses.

By working with Red Bike Advisors, you gain peace of mind knowing your finances are being reviewed by experienced professionals who understand both the numbers and the legal implications.

Why Choose Red Bike Advisors

Credentialed Experts

Our team includes CPAs, Certified Fraud Examiners (CFE), and financial forensics specialists.

Comprehensive Approach

We combine forensic accounting techniques with targeted fraud investigations to give you a full picture.

Clear Communication

We present findings in a straightforward, actionable format.

Confidential & Professional

Every case is handled with discretion and respect.

Take Action

If you suspect fraud, face a business dispute, or need help making sense of complex financial records, don’t wait. Early action limits damage and speeds recovery. Contact Red Bike Advisors today to schedule a confidential consultation and learn how our forensic accounting and fraud investigation services can protect your business.

What Clients Say

Book Your Free Strategy Session

Build the business you've always wanted. Let us handle the finances and tax.