Conquer Your Cash Flow with Red Bike Virtual CFO Services

Rest easy knowing you can make payroll–and bank a nice profit at the end of the year.

Tax Panic

How much do I owe? Do I have the cash?

Budget Pain

Like having an annual financial root canal

Payroll Pressure Paranoia

Lying awake wondering if you have enough in the bank

Vicious Debt Cycle

Funding operations with a LOC instead of cash

Capacity Crunches

Grow then hire, or hire to grow?

Lost in Translation

Where did my cash go when the accountant says I’m profitable?

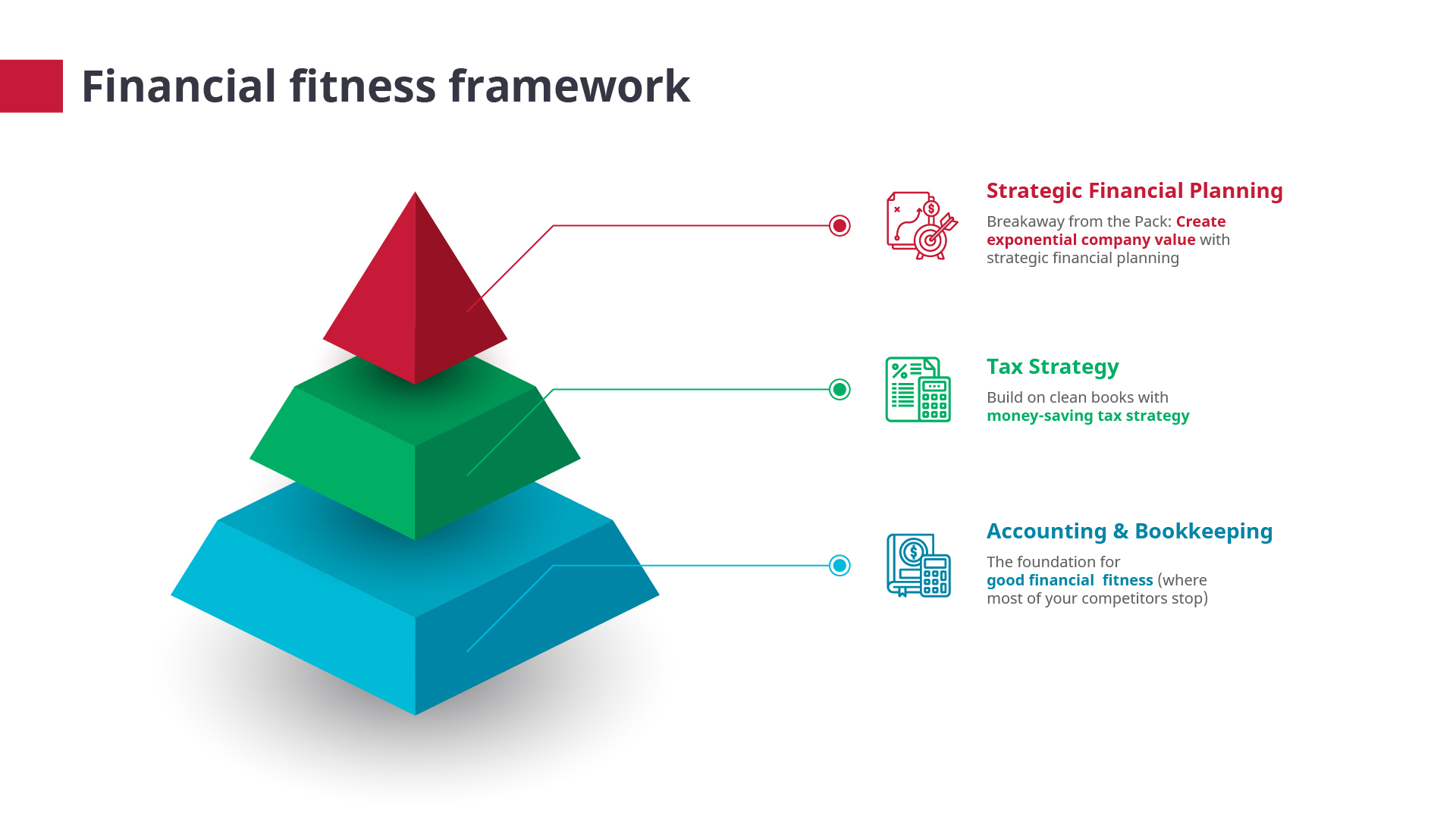

The Truth About Your Competitors

How to Have a Thriving Business

How Strategic Financial Planning Transforms Your Company

| Without VCFO | With VCFO | |

|---|---|---|

| Growth & Performance | I’d like to grow but don’t have the financial know-how to plan right. | Exponentially increase company performance with forecasting & KPIs |

| Profitability | I’ll find out if I made any money at the end of the year? | Determine ideal profit margin and budget to it—profit first! |

| Cash Flow | Where’s my money going? Can I pay the bills? | Never lie awake wondering where your money’s gone again. |

| Peace of Mind | I can’t predict the future and am stuck in a vicious cycle of reactivity | Proactively manage risks and uncertainties as a competitive edge. |

Introducing Red Bike Advisors Virtual CFO Services

Flat, Transparent Pricing

In your free strategy session, we uncover your exact needs and propose a complete solution to help you achieve your business goals. No hidden costs, upcharges, or billing in six-minute increments.

Three Service Tiers

Our Starter, Growth, and Expansion tiers are designed to give you exactly the level of support you need at your current growth stage, and you can adjust up or down at any time as you grow.

Optional Add-Ons

Customize your service package today with add-on services including tax strategy & filing and ad-hoc accounting & bookkeeping services.

Plans Built for Small and Growing Businesses

Finance Strategy Starter

Set measurable targets and manage cash flow for growth.

Average

$3,000/month

Ideal for growing companies with $500K-$1.5M revenue and 5-15 employees

- Monthly actuals to budget, cash flow, rolling forecast

Finance Strategy Growth

Forecast and grow with cash flow management and forecasting.

Average

$5,000/month

Ideal for growing companies with $1-5M revenue and 10-50 employees

- Biweekly actuals to budget, cash flow, rolling forecast

Finance Strategy Expansion

Predict, and optimize with CFO as key member of your management team.

Average

$6,500/month

Ideal for structured organizations with $5-20M revenue and > 50 employees

- Weekly actuals to budget, cash flow, rolling forecast

- Headcount & compensation planning

- Marketing performance

- Scenario planning: Lag, Pack, Lead

*Average pricing is listed to give you an idea of the investment in a strategic financial partner like Red Bike Advisors. We’ll customize your plan during your free strategy session.

Each Plan Includes

- Performance Assessment: Industry Benchmark Report

- Red Bike Advisors Growth Roadmap™: 10-year Roadmap, 3-year goals, 1-year targets, and quarterly execution map

- Annual Cash Flow Plan

- Quarterly Business Reviews

- “Know Your Numbers” monthly financial reports & reviews

- Monthly payroll reconciliation

Bonuses

- “Get Structured” Business Structuring Template

- Competitive Advantage Worksheet

- Productized Services Map

- Recurring Revenue Worksheet

Optional Add-Ons

- Tax strategy & filing

- Additional bookkeeping services

- Tax controversy & resolution services

- Fraud & forensic services

Who are Red Bike Advisors Virtual CFO Services for?

- Growing companies and structured organizations that need strategic financial advice but aren’t large enough for a full-time CFO or Controller

- CEO and/or management team is ready to bringing in strategic financial leadership as a key member of your extended management team

- You are committed to business and financial excellence and growth

A True Investment

Red Bike Advisors Virtual CFO Services aren’t a cost center, but a profit center.

Do Nothing | Full-Time Team | Red Bike Advisors |

| CFO $250K+ salary + benefits Sr. Accountant $100K salary + benefits Bookkeeper $60K salary + benefits Total: $410K+ annually | VCFO Full Service

Average annual investment: $70K

ROI: Priceless! |

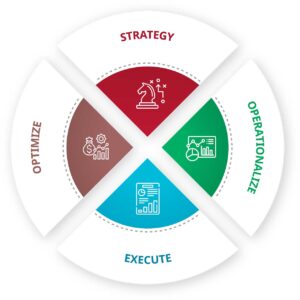

Strategy

10-year vision, 3-year plan, and annual operating plan

Operationalize

Implement technology, processes, financial and KPI dashboards, and meeting cadence

Execute

Quarterly, monthly, bimonthly, weekly reviews and optimizations

Optimize

Adjust and optimize to meet the Annual Operating Plan goals; feed learnings into next strategy session

Frequently Asked Questions

Virtual CFO and Finance Strategy

A Virtual CFO is a perfect happy medium between a Fractional CFO and a full-time, in-house CFO. Typically, a Fractional CFO is called in for a period of time, often in a turnaround situation where a company needs financial help, fast and furious, and they help make hard decisions to keep the company afloat and eventually to thrive. Or, they may be called in to fill in for someone on a leave of absence or while the CEO regroups after the CFO’s departure and considers next steps.

A full-time CFO is an employee of your organization and is appropriate for larger companies, but generally unaffordable for small businesses. Which brings us to a Virtual CFO: At Red Bike Advisors, we believe that every small business should have access to financial and tax insights that create exponential value for their companies, customers, employees, and families. Our Virtual CFOs are long-term partners that work with you and your management team to create and execute on your business and tax strategy. We combine a deep understanding of how finance plays a role in business growth combined with a deep understanding of your specific business, industry, and strategy to help you achieve your growth goals.

A Virtual CFO is like an extension of your leadership team that takes your strategic business goals and translates them into financial drivers that will help you meet those goals. Common goals we tackle from the financial perspective are revenue growth, profit growth, determining and saving the right amount of working capital, fostering a customer-centric culture, attracting, recruiting, and retaining top talent, and creating transferable business value for when you’re ready to exit.

If we were to draw a Venn diagram, there would be an overlap in the two circles of “Virtual CFO” and “CPA” because sometimes they are both, and sometimes not. A CPA is a good professional license to have for our Virtual CFO and Tax Strategy services, but it’s not required. What is required of our VCFOs is business finance experience as a CFO, CPA, senior financial analyst or controller, plus soft skills around strategic, “analytically creative” thinking, the ability to analyze data, form insights, and recommend courses of action, and excellent communication.

We typically start working with growing companies once they’ve passed $2M in annual revenue or are a funded startup. This is where you need to make critical decisions around hiring, forecasting, and budgeting that could make or break your cash flow situation and therefore your business.

Prior to that, we offer monthly and quarterly Financial Fitness Checkups to review your Management Reports and make recommendations.

Often when companies hit around the $20M mark, they “graduate” from our Virtual CFO services to their own full-time staff.

P.S. You can also take our 5-minute Financial Fitness Checkup and see whether you’re ready for your own VCFO.

First of all, we think of our services as an investment rather than a cost center. What’s the difference? A cost is something you put money into but don’t get a ton of exponential value from. With an investment, you put money in and get more money back! An investment in strategic finance and tax planning will help you grow your business, bring clarity to your finances, and help you answer big questions like when to hire and how to position for exit.

That said, see our average pricing above. We’ll do a free Strategy Session with you to understand your business and growth goals, then proposed a customized but fixed price for everything you need to achieve those goals. Why don’t you go ahead and get your session booked now?

We start with a free strategy session in which we get to know you, your business, and your growth goals. Then we put together a flat-fee services proposal that is designed to help you meet (and exceed) those goals. When you accept the proposal, we schedule a formal kickoff and onboarding period in which we create your 3-year strategic plan, annual operating plan, and cash flow plan, and build out the processes and dashboards to operationalize those plans, execute on them, and analyze performance. For more information on the process, see our Virtual CFO Services page.

We work with small but growing businesses in all industries that are earning between $2M and $20M in revenue. While there are certainly industry-specific nuances, drivers, and KPIs, every small business is focused on one or more of these key drivers: Revenue growth, profit growth, determining and saving the right amount of working capital, fostering a customer-centric culture, attracting, recruiting, and retaining top talent, and creating transferable business value for when you’re ready to exit.

Within those goals we can generally break down into service businesses or lines of business and product businesses or lines of businesses. That changes the key drivers of each goal; for example, if your goal is growing profit margin from 5% to 20%, if you’re a service-based business we’re going to look closely at your headcount and utilization; if you’re a product-based business we’re going to look closely at COGS and CapEx.

Finally, we do have a particular focus on dentists & medical professionals as well as B2B services and professional services.

Our mission at Red Bike Advisors is to equip our clients with financial and tax insights that create exponential value for their companies, customers, employees, and families—and ultimately create generational wealth. Like you, our CEO Gretchen Roberts is a small business owner who has always craved a strategic relationship with her finance, tax and accounting partner, but many accounting and tax firms reactively call once a year for tax papers and don’t truly advise unless you ask them a direct question. (Which means you already have to know what to ask instead of relying on them to analyze your situation and make proactive recommendations!)

We set out to create the kind of services that we’d want as a business owner that will help her answer big questions like “how many people do I need to hire this year to meet my growth goals?” and “how much cash should I keep in the bank?” and “which marketing tactics and channels should I double down on?”

If you crave that kind of relationship with your finance & tax strategy advisor, then give us a shout.

Not that we love losing clients, but we LOVE losing clients because we’ve helped them grow to the point that they have actually outgrown us! We are thrilled to work with you in any capacity to ensure a successful transition, including participating in your interview panels, helping to onboard your new CFO, and ensuring a smooth transition between us and them.